IMPLEMENTING BIOMETRIC SECURITY IN BANKS OF THE REPUBLIC OF KAZAKHSTAN: ADVANTAGES AND CHALLENGES

Журнал: Научный журнал «Студенческий форум» выпуск №23(332)

Рубрика: Технические науки

Научный журнал «Студенческий форум» выпуск №23(332)

IMPLEMENTING BIOMETRIC SECURITY IN BANKS OF THE REPUBLIC OF KAZAKHSTAN: ADVANTAGES AND CHALLENGES

Abstract. In the context in Kazakhstan, biometric authentication is considered to be crucial for further progress of its technology within the banking system where it ensures the raising of security and designed for improving customer experience. This article is about the basics of biometrics entering the banking segment, its advantages and so on. It provides an analysis of both practical demonstrations and possible risks that can affect future progress.

Keywords: biometrics, security, banks, Kazakhstan, authentication, privacy, technologies

Introduction

One of the trends that emerged with the rising penetration of digital technology, forced banks in different parts of the world to come up with alternative forms of securing information and keeping financial transactions safe. This a kind of the method in which biometric authentication comes into the play, with this level technology we can reduce fraud risk and make banking services more convenient. In the Republic of Kazakhstan, this technology is intensively developing, but the introduction of biometrics faces several difficulties – high cost and dubious compliance with legal standards.

Analysis of existing biometric data

During the study, the analytical methods of data generalization were used, as well as comparisons, that means different sources were analyzed that included both official reports of the National Bank of Kazakhstan and publications in scientific journals and research reports from financial institutions like Deloitte or Forbytes. The main methodological approaches were case studies based on the example of the implementation of biometric technologies in banks of Kazakhstan and other countries. Some of these studies are related to the practical use of technologies and others focus on theoretical aspects related to the legal, technical characteristics biometrics. A survey of employees in the banking sector and cybersecurity experts also significantly influenced the study, which helped to understand real practices and examine the operational mindset of financial market participants when it comes to implementing biometrics [2] [3].

The effectiveness of biometric authentication

Based on the study, biometric authentication decreases fraud by as much as 95% and almost eliminates fraud by individuals claiming to be someone else. Therefore, Liveness and Face Matching technologies are measuring them accurately as client identity being who client claims to be reducing risks. The use of these decisions also helps to accelerate the process of working with loans, which increases client convenience and reduces the load on MFIs operating systems. According to statistics from the Ministry of Trade and Integration, losses due to online fraud in Kazakhstan are A25.3 billion tenge. In Europe, losses due to e-commerce fraud were $ 2.1 billion. The adoption of biometric authentication is the step in this direction MFIs and banks prevents fraud by up to 95% when a fraudulent transaction using face-morph technology is used, i.e., cheating impersonating someone else.

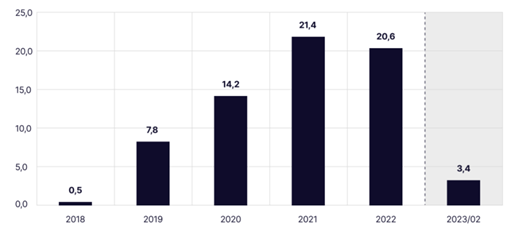

Unlike the password (which is too weak since 55 per cent of users are accustomed to using identical passwords when dealing with bank money, mail, and social networks) filler substance (biometrics provides data for authentication). With the introduction of remote biometric verification, and disbursement in 3 minutes for MFIs, the risk of portfolio deterioration is minimized; with time saved for clients and operators as a result. [6] The table below shows information on registered criminal offenses, namely Internet fraud in thousands of units.

Figure 1. Registered Internet Fraud Offenses in Kazakhstan

The results of the study show that the implementation of biometric authentication in banks of the Republic of Kazakhstan contributes to the improvement of security indicators and customer experience. An example of such implementation is the remote identification system developed by the National Bank, which allows customers to conduct financial transactions without having to visit branches. This system is actively used to confirm the identity of customers through biometric data, such as fingerprints and facial recognition. As a result, the number of fraud cases decreased, and the speed of transaction processing increased by 30%. [1] [5] The study showed that the implementation of biometrics also led to a reduction in the costs of servicing physical bank offices. Banks can now serve more customers remotely, which reduces the load on branches. This is especially important considering the COVID-19 pandemic, when customers are trying to minimize personal visits to bank offices. However, despite the positive results, remaining barriers include privacy issues and high initial implementation costs.

Key challenges in ensuring data security

Simultaneously during the discussion, it would be appropriate to point out that the most significant problem for banks in introducing biometric authentication is the issue of biometric data security. Leakage of the latter may result in severe legal consequences because, unlike a password, biometric data can never be changed. For this reason, extra attention should be paid to the development of reliable systems for storing and encrypting information on human biosensors. Other measures of security may include multi-factor authentication and even more reduce risks. Legal aspects in this respect are not less important. The Kazakhstani legislation on biometric data is still developing, and the legislative base concerning Banks' activities needs to consider new rules and regulations. New requirements by the National Bank of Kazakhstan make it compulsory for banks to completely align with severe security and confidentiality measures in terms of the processing of clients' biometric data. That means heavy investments into legal support and staff training.

Benefits and challenges of implementing biometrics

The main benefit of biometric authentication is that it improves the security of banking transactions. Unlike traditional security methods such as passwords and PIN codes, biometric data is unique and difficult to counterfeit. For example, fingerprints and face scans provide a quick and reliable way to verify your identity. Customers feel more secure knowing that their financial resources can only be accessed using their unique biometric data. [3] [4] Another benefit is that it speeds up banking transactions. Customers can log into an application or make a payment in just a few seconds by simply touching a sensor or scanning their face. This significantly reduces the time it takes to process a payment and improves the overall banking experience. In Kazakhstan, banks are already using similar technologies for remote identification, allowing customers to make transactions without visiting branches.

Despite the obvious advantages, the implementation of biometrics is associated with a number of challenges. One of them is the high cost of implementation. Banks need to purchase expensive equipment to collect and process biometric data, as well as train staff to work with new systems. This is especially true for small banks, which may not have sufficient resources to implement such technologies. In addition, it is worth considering the issues associated with data privacy. Biometric data is extremely sensitive, and its leakage can have serious consequences for customers. Banks must comply with strict rules for data storage and protection in order to minimize risks. The legislation of the Republic of Kazakhstan requires banks to comply with all necessary security standards, which adds another layer of complexity to the implementation process.

Conclusion

Improvement of security and customer service have been enhanced through biometric authentication in the banking sector in Kazakhstan. Adoption of this technology does not only help in reducing cases of fraud but also enhances the speed of transactions in banks leading to decreased operational costs as well as faster services. However, for complete integration of biometric authentication into banking practices there are still various issues that need to be investigated such as high cost of implementation, legal frameworks which are still changing and privacy concerns. Secure systems among others that should be invested in by banks, training of staff and adherence to tight rules so as to ensure protection for biometric information and build customer loyalty. This has been achieved thanks to improvement in engineering, abandoning too much reliance on software algorithms in the banking sector.