THE CURRENT STATE AND TRENDS IN THE DEVELOPMENT OF THE RUSSIAN FINANCIAL SYSTEM

Журнал: Научный журнал «Студенческий форум» выпуск №9(276)

Рубрика: Экономика

Научный журнал «Студенческий форум» выпуск №9(276)

THE CURRENT STATE AND TRENDS IN THE DEVELOPMENT OF THE RUSSIAN FINANCIAL SYSTEM

Abstract. The paper examines the current state of the Russian financial system and analyzes the trends of its development. The role of the main elements of the financial system and the features of their functioning are also defined: the banking system, the securities market, the insurance system. Special attention should be paid to the State and its role in regulating and supporting the financial system. The results of the study show a positive development trend.

Keywords: financial system, trends, development, banking system, securities market, insurance system.

Introduction. The financial system plays an important role in the economy of any state. Financial institutions are responsible for the formation of an effective financial system in Russia [1, p. 27]. They provide effective functioning of the money market, as well as financial resources for the development of enterprises and individual consumers. The modern financial system of Russia has undergone significant changes in recent decades, and today it continues to undergo development in the face of new challenges and opportunities in the global economy. But innovation remains an important component. It is necessary to intensify the processes of innovative development in the financial sector of Russia [2, p. 85].

Methods and organization of research. The results of this study were obtained using the following methods: analysis, analogy, comparison, synthesis.

The state of the financial system is expressed in the development of its elements, one of the main elements is banking. The Bank of Russia plays a key role in maintaining the stability and sustainability of the country's financial system [4, p. 118].

In the Russian Federation, the banking system is in constant development and improvement, it includes a wide range of financial institutions. Banks provide various services, such as opening accounts, issuing loans, providing insurance and investment opportunities.

In recent years, the Russian banking system has become more stable and reliable, thanks to increased regulation and supervision. A number of measures have been taken to increase the quality of assets, strengthen the capitalization of banks and prevent insolvency. Moreover, reforms are being carried out to increase transparency and protect the interests of consumers of financial services.

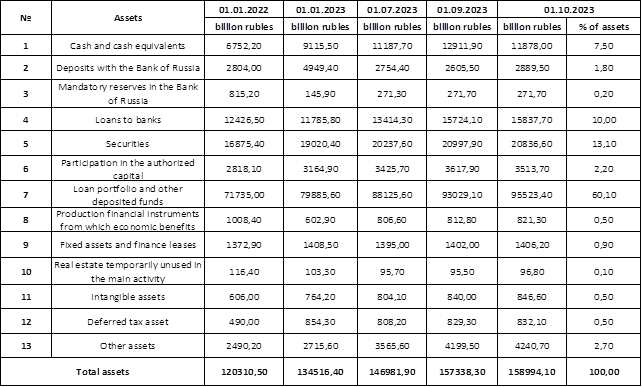

In general, the current state of the Russian banking system reflects the desire for stability, reliability and progress (Fig. 1).

Figure 1. The structure of assets of credit institutions grouped by investment areas

From 01.01.2022 to 01.01.2023, the volume of assets in the Russian banking industry increased from 120,310.5 billion rubles to 134,516.4 billion rubles. And by the end of 2023, the volume of assets had already amounted to 158 994.1 billion rubles. Despite the economic difficulties that have arisen, there is an increase in the volume of assets in the banking sector.

Thus, the capitalization of assets in the Russian banking sector continues to grow, despite the crisis situation and the fall of the stock market in the economy. Thanks to the activity of banks, the efficiency of resource allocation is improved, as they select the most attractive investment projects using investment analysis and risk management tools.

One of the key trends in the securities market in Russia is the rapid growth in trading volumes and interest from institutional and retail investors. This is due to the attraction of new issuers, the introduction of modern technologies into the trading infrastructure and a high degree of market transparency.

Government agencies are actively working to improve regulation and the regulatory framework in order to create a favorable investment environment. Considerable attention is also paid to the development of investment funds, which contributes to the diversification of investments and increase market stability.

To consider the stock market in more detail, let's turn to the data of the Moscow Stock Exchange presented in Table 1.

Table 1

The index for the Moscow stock exchange for the year 2022 and 2023 in Russia, rub.

|

The Moscow Stock Exchange Index |

|

|

Date |

Meaning |

|

2022 year |

|

|

03.01.2022 |

3753,29 |

|

04.04.2022 |

2592,72 |

|

04.07.2022 |

2222,51 |

|

03.10.2022 |

1944,75 |

|

2023 year |

|

|

03.01.2023 |

2156,39 |

|

03.04.2023 |

2508,39 |

|

03.07.2023 |

2832,51 |

|

02.10.2023 |

3144,89 |

Source: The Moscow Stock Exchange Index data

The table data shows that at the end of 2022, there was a sharp drop in the index compared to the beginning. The value fell from 3753.29 (as of 03.01.2022) to 1944.75 (as of 3.10.2022). The reasons for this drop were: increased geopolitical tensions, media information about a possible increase in taxes on oil exports. Investors began to sell their shares, fearing new sanctions due to the entry of new territories into the Russian Federation.

In 2023, the index began to grow after a strong fall, but is still experiencing great difficulties due to sanctions. The positive dynamics is associated with the strengthening of the economy, which contributed to an increase in dividend payments. The growth was also influenced by the withdrawal of foreign citizens from trading on the Moscow Stock Exchange, now the market is dominated by private investors. In September 2023, the share of individuals on the Moscow Stock Exchange was 81%.

In order to support the Bank of Russia, it has identified the main directions for the development of the stock market for 2023-2025. The priorities are: digitalization, improvement of the payment system, transformation of the system of foreign trade payments and settlements; restoration of citizens' trust in the stock market.

In addition to analyzing the state of the securities market, special attention should be paid to the state of the insurance system, since these are closely related factors influencing financial decisions of investors.

The current state of the Russian insurance system can be characterized as dynamic and in constant development. In recent years, there has been a significant growth in the insurance market, which is explained by the increased interest in protecting property, health, vehicles and other risks. The impact of new technologies also plays an important role in the transformation of this industry.

At the beginning of 2023, the volume of insurance premiums increased significantly relative to the 1st quarter of 2022. This was influenced by the sharp deterioration of economic conditions in the period from February to March 2022, which led to a decrease in activity in the insurance market and a reduction in fees.

The types of insurance related to lending have become the drivers of growth for the insurance market. The sharp increase in life insurance is associated with an increase in lending to individuals.

The volume of the insurance market at the time of the 1st quarter of 2023 amounted to 584.4 billion rubles, in percentage terms it is 21.2%. Growth is also observed in all types of insurance. This was influenced by: an increase in demand for car insurance and an increase in the cost of CTP caused by the rise in prices of cars and spare parts, the activation of insurers in the field of housing and communal services.

One of the key trends in the Russian insurance system is the development of digital technologies. Online platforms and mobile applications greatly simplify the process of purchasing and managing insurance policies, making it more convenient and accessible for customers. The introduction of electronic documents and digital signatures also improves the efficiency of processes in insurance companies.

In addition, insurance companies are actively adapting to the changing needs of customers by offering innovative products and services. For example, the development of open innovation, special programs for startups and small businesses.

The modern insurance system in Russia is going through a period of active modernization and improvement. Through the use of new technologies and the versatile development of insurance products, it strives to ensure reliable protection of clients' interests and contribute to the sustainable development of the country's economy.

Based on the state of the elements of the financial system of the Russian Federation, it can be concluded that it is in constant development, reflecting global trends and the desire for improvement. In recent years, several key trends have been observed that determine the development of the financial system in the country.

The first trend is digitalization and digitalization of financial services. Digital technologies are changing the conduct of transactions in the financial sector and forming new development trends [5, p. 51]. More and more banks and financial institutions in Russia are switching to electronic payment systems, offering online banking and applications for clients. This simplifies access to financial services, increases efficiency and speeds up processes.

The second trend is the development of the investment sector. The Russian market is becoming more attractive to investors due to ongoing reforms and improvement of the legal framework. The introduction of new instruments, such as bonds for private investors and pension funds, promotes capital inflows and increases interest in Russian assets.

The third trend is the strengthening of the role of the state in the financial sector. Regulators and the government actively interfere in market processes, creating conditions for the development of financial institutions and ensuring financial stability. The introduction of new regulations and control over financial reporting contributes to improving the reliability and transparency of the financial system.

Conclusion. The development of Russia's modern financial system is closely linked to global economic trends. Current trends in the development of the Russian financial system reflect the desire for innovation, digitalization and improvement of conditions for all market participants. The development of new technologies, investment promotion and cooperation with global partners play a key role in ensuring the sustainable and efficient functioning of the country's financial system.