MODERN PROBLEMS AND TRENDS IN THE DEVELOPMENT OF THE FINANCIAL SYSTEM OF THE RUSSIAN FEDERATION

Журнал: Научный журнал «Студенческий форум» выпуск №10(277)

Рубрика: Экономика

Научный журнал «Студенческий форум» выпуск №10(277)

MODERN PROBLEMS AND TRENDS IN THE DEVELOPMENT OF THE FINANCIAL SYSTEM OF THE RUSSIAN FEDERATION

Abstract. This article examines the development and trends of the financial system in Russia, its problems, as well as the importance of the Russian financial system for the country. The relevance of using the infrastructure of financial markets is reflected, modern trends in the financial sector in the context of digitalization of the economy are analyzed, the role of sanctions affecting the country's exports is considered. Activities have been identified that will contribute to the achievement of the renowned goals of the Central Bank in the development of the financial system of the Russian Federation.

Keywords: financial system, Russian exports, digitalization, trends in the financial system.

The financial system in Russia is a complex network of institutions, rules and markets that facilitate the movement of money and capital within the country. It plays a crucial role in supporting economic growth, attracting investment and ensuring stability in the Russian economy.

The Central Bank of Russia is the main regulatory body responsible for overseeing the financial system. He formulates and implements monetary policy, controls banks and maintains price stability. providing banks with liquidity during periods of financial stress.

In recent years, Russia has made efforts to modernize its financial system and attract foreign investment. The Government has implemented reforms to increase transparency, strengthen regulation and enhance investor protection. These measures helped to increase confidence in the Russian financial system and led to a gradual influx of foreign capital. However, over the past few decades, the country has gone through special economic and financial reforms, moving from a centrally planned economy to a market system.

The financial system of the Russian Federation underwent significant changes in 2022-2023, caused by various factors such as economic reforms, geopolitical events and technological advances. These changes were aimed at strengthening the country's financial stability.

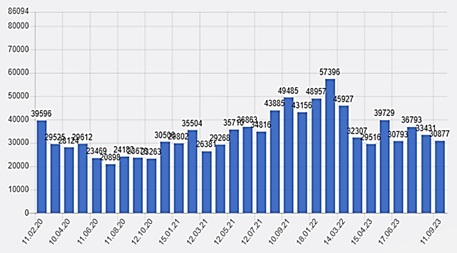

In 2022, the Russian economy faced unprecedented sanctions. Sanctions can negatively affect a country's exports, as they restrict access to certain markets and services of other countries. Sanctions also affect the reputation of the Russian Federation as a reliable partner for trade, which can negatively affect export volumes due to the deterioration of relations with other countries. Let's turn to Fig. 1 to consider the volume of Russian exports for 2020-2023.

Source: Federal Customs Service of the Russian Federation

Figure 1. The volume of Russian exports (2020-2023), in millions of US dollars

In 2022, the volume of exports decreased slightly due to sanctions and restrictions. The volume of exports to Russia fell to 30,877 million US dollars in July 2023. The maximum volume reached 50,248 million US dollars, and the minimum was 4,100 million US dollars.

With the help of timely support measures, the Russian Federation was able to stand in the economic system. Nevertheless, the financial sector will have to adapt to new realities in the near future.

In 2022, the Bank of Russia in the project document "Main directions of development of the financial market of the Russian Federation for 2023-2025" names three priorities for the financial sector for the specified period: digitalization, improvement of the payment system; restoration of citizens' trust in the stock market; transformation of the system of foreign trade payments and settlements.

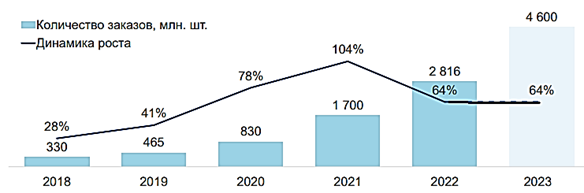

The Central Bank of the Russian Federation intends to activate the role of the capital market in financing enterprises. In addition, the regulator seeks to maintain public interest in the stock market, which has stabilized in recent years. To this end, the Central Bank of the Russian Federation plans to contribute to the preservation of the stability of professional market participants and calls for strengthening the protection of investors' rightsThe digitalization of finance in Russia is taking place against the background of the growing volume of online commerce in the country. Let's turn to Fig. 2 to consider the dynamics of the number of orders in the Russian Federation for 2018-2023.

Source: Data Insight data.

Figure 2. Dynamics of the number of orders in the Russian Federation (2018-2023), in %

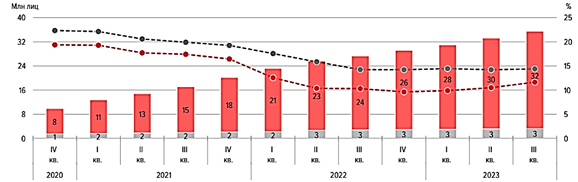

According to the report of the Bank of Russia, starting from the second quarter of 2022, there has been a significant slowdown in the growth of clients who use brokerage services due to geopolitical difficulties and the expansion of Western sanctions. As a result of the third quarter, it is clear that the activity of clients with brokerage accounts reached the lowest level in the last few years. The main factors that contributed to this were the announcement of mobilization and the deterioration of economic and consumer expectations of the population. Let's turn to Fig. 3 to consider the dynamics of the number of clients in brokerage services and the share of active clients in 2020-2023.

Source: The Bank of Russia.

Figure 3. Dynamics of the number of clients in brokerage services and the share of active clients (2020-2023), in %

In the third quarter of 2023, there has been a record increase in the average size of Individual Investment Accounts over the past three years. Last year, during the uncertainty of 2022, investors preferred not to make decisions and wait. However, according to the results of the third quarter of 2023, the volume of portfolios increased by 9% compared to the same indicator in 2021, and this was achieved due to the negative revaluation of Russian shares in September and the withdrawal of funds by customers.

To protect private investors and minimize their risks, the Bank of Russia proposes to take the following actions:

1. Improve the testing procedure for retail investors.

2. Change the requirements for obtaining the status of a qualified investor.

3. Expand the list of tools for qualified investors.

Increasing the required size of assets and establishing it as the only criterion for obtaining the status of a qualified investor is one of the measures that the Bank of Russia intends to introduce in order to attract more investors to the stock market. However, some experts have expressed doubts about this measure.

In the next two years, the Bank of Russia plans to carry out extensive work to restore the financial sector. The main focus will be on expanding foreign trade and financial ties with friendly countries, as well as protecting the interests of consumers of financial services and ensuring their security, in order to stimulate the development of the stock market. In conclusion, we note that the financial system in Russia is an essential component of the country's economy. Despite the significant progress made in recent years, further reforms and improvements are needed to ensure stability, attract investment and support sustainable economic growth. Modern problems and trends in the development of the financial system of the Russian Federation are related to the need to ensure the stability and stability of the financial system, increase its efficiency and competitiveness at the global level. To achieve these goals, it is necessary to improve the regulation and control of financial organizations, develop financial technologies and infrastructure, and strengthen international cooperation in the field of finance.